Western Europe Yogurt Powder Market to Rise USD 233.1 million by 2035; Skimmed Variants Secure 59% Market Dominance

Rising demand for yogurt powder in Western Europe is driven by clean-label and high-protein trends, convenience in foodservice and bakery applications

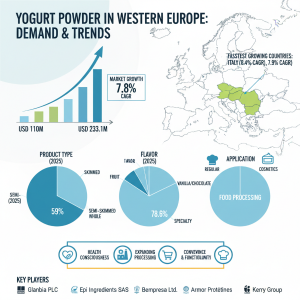

NEWARK, DE, UNITED STATES, October 20, 2025 /EINPresswire.com/ -- New market analysis projects the Western European Yogurt Powder market to more than double in value over the next decade, with sales rising from an estimated USD 110 million in 2025 to USD 233.1 million by 2035. This robust expansion reflects a Compound Annual Growth Rate (CAGR) of 7.8%, underpinned by profound shifts in regional food manufacturing, evolving consumer health priorities, and critical geographical disparities in adoption rates.

The data, released in the "Yogurt Powder in Western Europe: Size, Share, and Forecast Outlook 2025 to 2035" report, confirms the ingredient’s transition from a specialized commodity to a core functional component across the region’s expansive food industry. The authoritative outlook highlights that the primary growth dynamic is being driven not by established dairy hubs, but by nations leading culinary and ingredient application innovation.

Geographic Acceleration: Italy and Netherlands Lead the Growth Curve

The analysis reveals a significant divergence in growth trajectories across major Western European economies, signaling distinct opportunities for strategic market penetration. Italy and the Netherlands are forecast to record the highest Compound Annual Growth Rates (CAGRs) over the forecast period (2025-2035), outpacing traditional food processing centers like Germany and the UK.

• Italy is projected to achieve the fastest growth at an 8.4% CAGR, with sales forecast to reach USD 58 million by 2035, a direct result of strong culinary heritage that is rapidly embracing dairy innovation and advanced food processing infrastructure.

• The Netherlands follows closely with a projected 7.9% CAGR, driven by its strength as a key trading and industrial processing hub, with sales expected to hit USD 46.9 million by 2035.

• France demonstrates a solid growth forecast of 7.3% CAGR, leveraging its sophisticated food processing sector and demand for artisanal and specialty applications, with projected sales reaching USD 42 million.

"The localized growth acceleration in Italy and the Netherlands is a clear indicator that market success hinges less on existing market size and more on the embrace of ingredient innovation and functional application development," states the report's lead analyst. "These countries are spearheading the rise in per capita consumption, which is set to climb from an average of 0.8–1.2 kg in 2025 across leading nations to approximately 1.6 kg by 2035."

Skimmed Variants Dominate as Health-Consciousness Dictates Product Mix

The report’s granular segment analysis confirms that product functionality and consumer health-consciousness are the critical factors shaping market share.

• Product Type Dominance: Skimmed yogurt powder formulations are projected to capture a commanding 59% value share of the total market in 2025. This dominance is attributed to strong demand from food manufacturers seeking low-fat, high-protein ingredients that cater to pervasive weight management and health-aware consumer trends across Europe.

• Flavor Profile: The versatility and neutral processing profile of the ingredient ensures that the Regular flavor variant will continue to hold the largest share, accounting for 78.6% of all sales in 2025. This preference underscores the ingredient's primary role in industrial food and beverage formulations where a neutral dairy base is required, even as specialty and fruit-flavored options expand their footprint in beverage and snack categories.

• Growing Premium Segments: While skimmed and regular variants dominate volume, the analysis highlights robust growth in premium segments. Whole yogurt powder is recording an estimated 18% annual growth, catering to indulgent and authentic dairy flavor applications. Furthermore, Organic variants across all fat content categories are gaining significant traction, fueled by the demand for clean-label ingredients and premium positioning within specialty retail channels.

Competitive Landscape and Strategic Imperatives

The competitive landscape is defined by the technical capabilities and established food processing relationships of key players, who collectively serve thousands of food manufacturing facilities across the region. Leading firms—including Glanbia PLC, Epi Ingredients SAS, Kerry Group, and Armor Protéines—are prioritizing extensive technical support and custom formulation services over simple product innovation.

Get this Report at $3500 | Claim Your Report at a Discount: https://www.futuremarketinsights.com/reports/sample/rep-gb-18635

Get PDF Brochure: https://www.futuremarketinsights.com/reports/brochure/rep-gb-18635

The report identifies that the decisive factors for market penetration and sustained growth are:

• Technical Application Support: Providing deep formulation and functionality expertise to food manufacturers.

• Clean-Label & Organic Certification: Meeting the increasing regulatory and consumer demand for transparent and premium ingredients.

• Industrial Channel Presence: Maintaining established, reliable relationships with large-scale food processors and distributors.

The expanding role of private-label programs by major ingredient distributors is noted as a force that will continue to drive price competition, emphasizing the strategic importance of technical service and robust supply chain management for category players.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.